Thanks to LP for introducing Student's blog. Do check out Process Driven Trading, he really put a lot of effort into it. :)

Want to know more about Quants? I watched this video sometime ago which is very interesting.

Thursday, January 6, 2011

Saturday, January 1, 2011

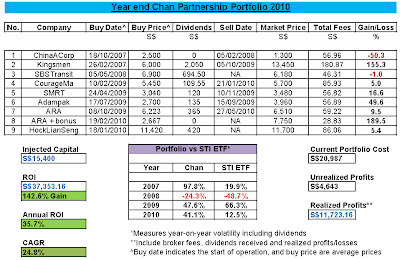

Year End Portfolio 2010

Happy New Year Everyone! Hope that you guys had a wonderful 2010! :D

Happy New Year Everyone! Hope that you guys had a wonderful 2010! :DI have been busy with a lot of other stuffs except blogging haha... If you are lucky, you might be able to catch me chatting in LP's blog.

Made a grave error in overstating the returns for Kingsmen and above is the edited 2009 portfolio. Taking into account of this error, which I only managed to detect it today! I have severely underperformed the STI ETF in 2009 by 18.7%! However, I usually perform better in bear markets than in bull markets.

Recall the performance yardstick.

The STI ETF ended the year 12.5% higher including dividends than where it ended in 2009. Dividends received was $0.06 or 2% at $2.97, 2008 market close. I outperformed the market by 28.9% which makes the score, 3 for me and Mr Market 1. :)

Yardstick

Like most things we do everyday, we should have a yardstick to measure performance. I hope to do better in bear markets than in bull markets as I'm looking for companies with good future prospects at depressed market prices. I would be happy if my portfolio can outperform the STI ETF by 10% each year. For example the STI ETF this year gained 22.1%, I would do well if I can achieve >32.1% gain in portfolio for the year. I also consider in a year whereby my portfolio is down 20% and the STI ETF down 30% to be a better year.

Is this luck or skill? Only time will tell. I've stayed with Mr Market for one cycle (bull-bear-bull) for the past 4 years. I guess to convincingly say that one is good, one should at least go through 3 cycles of the boom and bust. How long is one cycle? Nobody knows, it varies and is not exact science. Read uncle88's blog, quite funny haha...

Regards,

Cheng BSM (B.StockMkt, SG)

Ps: This title is made up and has no value whatsoever. Lol!

Monday, January 11, 2010

Year End Portfolio 2009

Dear all, sorry for the delay in my portfolio update and the lack of posts. Have been very busy in school. 2009 is a good year, I have gained more knowledge, became much wiser and met many more valuable friends! I am forever grateful to them. :)

This year I did not perform as well as I would loved to. The STI ETF gained 66.3% including dividends while my portfolio only gained 58.8% this year, underperformed the STI ETF by 7.5%. To recall, my goal is to beat the STI ETF by 10% every year. Annualised return was 28.3% and hopefully I can improve further.

Cashed out $10k to give some to Mom and went for a holiday to reward myself. Still have around $4k which I would transfer into my trading account.

I will post the lessons learn't in 2009 at a later date.

Always keep an open mind, doesn't matter if it's TA or FA. Sometimes both will work and sometimes both doesn't work. Depends on how you use it. LOL!

Wishing everyone a happy tiger year! (And Yes! It's my year again, haha...) :D

Friday, June 12, 2009

Probability & The Bet (My Answer)

Here is my answer, there are no right or wrong answers. My answer is steered towards how I would make this intelligent bet with Mr Market(The Stranger).

1) A stranger walked up to me and say that he has a fair coin in his hand. Which means that the probability of flipping the coin to get either heads or tails is 50%. The stranger said that he will flip the coin 20 times and wants me to guess what is the result of the 20th flip. There were no tricks involved during flipping, no foul play seen.

After the 19th flip, the result was 19 heads and 0 tail. He asked me to guess the result of the next flip. What is the probability of getting either heads or tails on the 20th flip?

What is your answer and your reasoning?

Mr Market walked up to me and said that he has a fair coin. Imagine the process of flipping up to the 19th flip. After 5 flips, 5 Heads. I thought to myself, the odds of 5 Heads in a row is around 3%(0.5^5) since there is an equal chance of getting heads or tails. After 10 flips, 10 Heads(something must be wrong, my alertness increases). After the 19th flip, 19 Heads and 0 Tail(he must be kidding me!). Either this coin is biased(Mr Market lied to me that this coin is fair) or the odds of this probability happening is very rare! We live in not a perfect world, people lie, cheat, steal etc. The market is a brutal place.

My opinion would be that this coin is biased, more weight is placed at the side of tails so it always lands on tails and show heads on top. Since it is a biased coin, 99%(what if Mr Market do magic trick?) the next flip would be Heads.

Let us go back to purely numbers and data that this is indeed a fair coin(Mr Market is not lying). The flip is independent and probability is non-accumulative or you can say that there is no conditional probability attached. The next flip either heads or tails is 50%, is correct. Doesn't matter if it is 10 Heads in a row or 1 Billion heads in a row.

If you said that the probability of Tails occurring at the 20th flip is very high(eg. >50%). You are wrong. Past data of the flip cannot predict accurately the outcome of the next flip. It just shows you that a rare event just happened, which is consecutive 19 Heads in a row.

If you think carefully, there are a lot of lessons that we could apply in the market.

2) The bet. The stranger said that if you want to bet, every $1 bet will give returns of 200%. If you lose, you lose all. Your R/R is 1:2. How many % of capital would you bet on this 20th flip to get optimal R/R returns, based on your probability answer given above?

I would use Kelly's formula(odds/edge) to bet. It is used to determine the optimal size of a series of bet when the odds are in your favor, in the long run. You are right no matter which case you choose because you do not know whether Mr Market is lying or not. Assuming 10k capital.

Case 1(not lying): 50% Head, 50% Tails, R/R 1:2

Your Odds:

(0.5 x 2) + (0.5 x -1) = 0.5

Odds/Edge:

0.5 / 2(divide by max win) = 25%

Bet 2.5K either heads or tails is the same.

Case 2(lying): 99% Head, 1% Tails, R/R 1:2

(0.99 x 2) + (0.01 x -1) = 1.97

1.97 / 2 = 98.5%

Bet 9.85K on heads.

However if I were to bet, I don't want to put 9.85k. I'm a conservative guy and don't want to risk almost all the money(call me a turtle gambler).

I bet on Heads by combining both scenarios adjusting probability to 100%:

(0.25 x 2) + (0.25 x -1) + (0.495 x 2) + (0.005 x -1) = 1.235

1.235 / 2 = 61.75%

Since I'm a turtle gambler and a value investor, with a 50% margin of safety, I would bet 3K(30%) of capital on Heads.

Kelly's formula also shows you how much confidence you have in the bet. In this case, my confidence level is 61.75%. If you think that the coin is fair, your confidence level would be 25%. In the stock market, most would bet if their confidence level is more than 70-80%. So if you said that you don't want to bet, you are right too. Like I said, there are no right or wrong answers, only bet with money that you can afford to lose.

1) A stranger walked up to me and say that he has a fair coin in his hand. Which means that the probability of flipping the coin to get either heads or tails is 50%. The stranger said that he will flip the coin 20 times and wants me to guess what is the result of the 20th flip. There were no tricks involved during flipping, no foul play seen.

After the 19th flip, the result was 19 heads and 0 tail. He asked me to guess the result of the next flip. What is the probability of getting either heads or tails on the 20th flip?

What is your answer and your reasoning?

Mr Market walked up to me and said that he has a fair coin. Imagine the process of flipping up to the 19th flip. After 5 flips, 5 Heads. I thought to myself, the odds of 5 Heads in a row is around 3%(0.5^5) since there is an equal chance of getting heads or tails. After 10 flips, 10 Heads(something must be wrong, my alertness increases). After the 19th flip, 19 Heads and 0 Tail(he must be kidding me!). Either this coin is biased(Mr Market lied to me that this coin is fair) or the odds of this probability happening is very rare! We live in not a perfect world, people lie, cheat, steal etc. The market is a brutal place.

My opinion would be that this coin is biased, more weight is placed at the side of tails so it always lands on tails and show heads on top. Since it is a biased coin, 99%(what if Mr Market do magic trick?) the next flip would be Heads.

Let us go back to purely numbers and data that this is indeed a fair coin(Mr Market is not lying). The flip is independent and probability is non-accumulative or you can say that there is no conditional probability attached. The next flip either heads or tails is 50%, is correct. Doesn't matter if it is 10 Heads in a row or 1 Billion heads in a row.

If you said that the probability of Tails occurring at the 20th flip is very high(eg. >50%). You are wrong. Past data of the flip cannot predict accurately the outcome of the next flip. It just shows you that a rare event just happened, which is consecutive 19 Heads in a row.

If you think carefully, there are a lot of lessons that we could apply in the market.

2) The bet. The stranger said that if you want to bet, every $1 bet will give returns of 200%. If you lose, you lose all. Your R/R is 1:2. How many % of capital would you bet on this 20th flip to get optimal R/R returns, based on your probability answer given above?

I would use Kelly's formula(odds/edge) to bet. It is used to determine the optimal size of a series of bet when the odds are in your favor, in the long run. You are right no matter which case you choose because you do not know whether Mr Market is lying or not. Assuming 10k capital.

Case 1(not lying): 50% Head, 50% Tails, R/R 1:2

Your Odds:

(0.5 x 2) + (0.5 x -1) = 0.5

Odds/Edge:

0.5 / 2(divide by max win) = 25%

Bet 2.5K either heads or tails is the same.

Case 2(lying): 99% Head, 1% Tails, R/R 1:2

(0.99 x 2) + (0.01 x -1) = 1.97

1.97 / 2 = 98.5%

Bet 9.85K on heads.

However if I were to bet, I don't want to put 9.85k. I'm a conservative guy and don't want to risk almost all the money(call me a turtle gambler).

I bet on Heads by combining both scenarios adjusting probability to 100%:

(0.25 x 2) + (0.25 x -1) + (0.495 x 2) + (0.005 x -1) = 1.235

1.235 / 2 = 61.75%

Since I'm a turtle gambler and a value investor, with a 50% margin of safety, I would bet 3K(30%) of capital on Heads.

Kelly's formula also shows you how much confidence you have in the bet. In this case, my confidence level is 61.75%. If you think that the coin is fair, your confidence level would be 25%. In the stock market, most would bet if their confidence level is more than 70-80%. So if you said that you don't want to bet, you are right too. Like I said, there are no right or wrong answers, only bet with money that you can afford to lose.

Friday, June 5, 2009

Probability & The Bet

Came up with this very lame question because I'm very bored haha... Posted it in Huatopedia forums and decided to post this Quiz/Question for my readers too! Hopefully we can learn from each other. If you could spend some time to think this through, you will learn something in the process. Good Luck!

1) A stranger walked up to me and say that he have a fair coin in his hand. Which means that the probability of flipping the coin to get either heads or tails is 50%. The stranger said that he will flip the coin 20 times and wants me to guess what is the result of the 20th flip. There were no tricks involved during flipping, no foul play seen.

After the 19th flip, the result was 19 heads and 0 tail. He asked me to guess the result of the next flip. What is the probability of getting either heads or tails on the 20th flip?

What is your answer and your reasoning?

2) The bet. The stranger said that if you want to bet, every $1 bet will give returns of 200%. If you lose, you lose all. Your R/R is 1:2. How many % of capital would you bet on this 20th flip to get optimal R/R returns, based on your probability answer given above?

Ps: R/R is Risk/Reward.

I will give my opinion in the next posting. =D

Edit: Spotted the mistake. The rest are correct. $1 bet will reward you $2, so total you will have $3. Sorry for the mistake.

1) A stranger walked up to me and say that he have a fair coin in his hand. Which means that the probability of flipping the coin to get either heads or tails is 50%. The stranger said that he will flip the coin 20 times and wants me to guess what is the result of the 20th flip. There were no tricks involved during flipping, no foul play seen.

After the 19th flip, the result was 19 heads and 0 tail. He asked me to guess the result of the next flip. What is the probability of getting either heads or tails on the 20th flip?

What is your answer and your reasoning?

2) The bet. The stranger said that if you want to bet, every $1 bet will give returns of 200%. If you lose, you lose all. Your R/R is 1:2. How many % of capital would you bet on this 20th flip to get optimal R/R returns, based on your probability answer given above?

Ps: R/R is Risk/Reward.

I will give my opinion in the next posting. =D

Edit: Spotted the mistake. The rest are correct. $1 bet will reward you $2, so total you will have $3. Sorry for the mistake.

Saturday, May 16, 2009

Update about myself

This week has been a hectic week. School work is starting to pile up with lots of materials to read. There have been some problems in school, which I feel is insignificant and not worth mentioning.

I have been monitoring the markets more and reading economic data extensively to get a general feel of the market, this has caused me to have insufficient sleep for the past 1 month. Made a few good buys and sells which I will not reveal now. Wait for end of the year to see my new portfolio allocation. :)

I have realised that there are so many things to do in life and I need to refocus. All these experiences costs money and the 2.5K salary that I'm going to bring home in the future is not going to get me anywhere. Anyway, I'm not in this profession for the money. I need to find ways to earn more, so that I can afford to spend more. I reiterate the word "afford" again, a prudent investor needs to spend within his means.

The compounding effect of money is simply too powerful to ignore. Having a capital of 100k and compounding it at 20% per year can be easily an average person's annual salary. If I can compound it 20% consistently for 5 years, I would have easily 248K. To the average person, it is a significant amount. To the one who has made it, it is just merely numbers.

I have stopped trading forex on paper months ago because there is not enough time to monitor while I'm in school. However I still believe that over time, I will be profitable. If anyone wants to pick up trading, forex is the way to go. Tough, brutal, challenging and it takes lots of discipline to control emotions. I don't like the idea of having rollover fees if I were to keep my trade the next day. Pitting your skills against the market is tough enough and yet as a retail trader, one has to pit their skills against the brokerage too. There are many wide swings and false breakouts to lookout for.

I need to refocus on what is important to me. Over the years, I've narrowed down and filtered out those that are not and kept those that are very important to me. I'm glad that time has made me realise this.

My focus now would be school work, trading/investments and the occasional drinks with my best pals. Life just keeps getting better. :D

I have been monitoring the markets more and reading economic data extensively to get a general feel of the market, this has caused me to have insufficient sleep for the past 1 month. Made a few good buys and sells which I will not reveal now. Wait for end of the year to see my new portfolio allocation. :)

I have realised that there are so many things to do in life and I need to refocus. All these experiences costs money and the 2.5K salary that I'm going to bring home in the future is not going to get me anywhere. Anyway, I'm not in this profession for the money. I need to find ways to earn more, so that I can afford to spend more. I reiterate the word "afford" again, a prudent investor needs to spend within his means.

The compounding effect of money is simply too powerful to ignore. Having a capital of 100k and compounding it at 20% per year can be easily an average person's annual salary. If I can compound it 20% consistently for 5 years, I would have easily 248K. To the average person, it is a significant amount. To the one who has made it, it is just merely numbers.

I have stopped trading forex on paper months ago because there is not enough time to monitor while I'm in school. However I still believe that over time, I will be profitable. If anyone wants to pick up trading, forex is the way to go. Tough, brutal, challenging and it takes lots of discipline to control emotions. I don't like the idea of having rollover fees if I were to keep my trade the next day. Pitting your skills against the market is tough enough and yet as a retail trader, one has to pit their skills against the brokerage too. There are many wide swings and false breakouts to lookout for.

I need to refocus on what is important to me. Over the years, I've narrowed down and filtered out those that are not and kept those that are very important to me. I'm glad that time has made me realise this.

My focus now would be school work, trading/investments and the occasional drinks with my best pals. Life just keeps getting better. :D

Thursday, March 26, 2009

Subscribe to:

Posts (Atom)